After they buy the loose tobacco and the tube papers, they rent time at the smoke shop's $35,000, freezer-sized rolling machine, which can roll a full carton in about 10 to 15 minutes. Eight ounces of loose tobacco -- which isn't assessed a wholesale tax in Pennsylvania, the only state without such a tax -- nets 200 cigarettes.

Employees of the tobacco shops will guide novice buyers through the process of using the filling stations, but they don't operate the machines themselves.

... They only make four cartons an hour," or about 800 cigarettes.

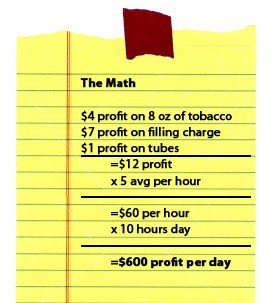

... RYO Machine Rentals boasts that tobacco store owners will see a 300 percent return on investment in the first year of putting in a machine, depending on what they charge to use the machine. "You can expect a 20-30 percent margin on a carton of RYO produced in your store," the company says.

The following is over-stated. Use 3 turns per hour, instead of 5. http://www.ryofillingstation.com/profit.php

The store would be private, only for those in the partnership/co-op. Each member can bring in a guest, though the guest may not purchase anything.

Sell organic and non-organic bulk tobacco. Rent rolling machine by the use/minute.

Sell herbs and remedies.

Sell free-range non-hormone meats, eggs, cheese. Sell raw milk.

Franchise/license the back-office support, startup, and management coaching of this business model.

Risk - change of state tax law or federal tax law.

No comments:

Post a Comment